Buyer beware.

It is all the rage. The ads pop up, the messages come through promising the path to gold. “Wealth screen your donors through OUR service. We’re better, faster, cheaper.” But does wealth screening really end up raising more revenue?

What is Wealth Screening?

Wealth Screening is a data process that nonprofits use to determine each donor’s capacity to give. It’s also a way to identify new donors. As a subset of prospect research, a wealth screen looks at the top indicators of wealth like real-estate ownership, business affiliations, and stock holdings in public companies. It has an important place in fundraising, and, despite our caution, it is actually an underused tool; but knowing how to use it makes all the difference.

Wealth Screening your current donors and identifying new “value-aligned” donor prospects no doubt provides you essential data. That data includes securing the donor’s date of birth (essential for knowing your planned gift prospects), what college they attended, and what gifts they have made to other nonprofits. All of the data is appended directly to the donor record in your donor database, so you have easy access to it, but the fundraising process is not just about the data alone.

Four Stages

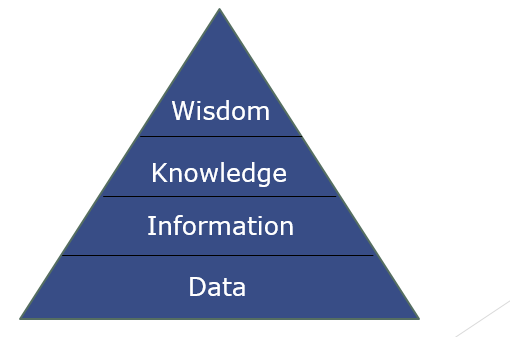

We have observed four stages of wealth screening as follows:

Each of these stages answers a different question that is essential to your advancement efforts and to organizational growth.

Here are the questions:

Data: What can I learn about my donors?

Information: What reasonable assumptions can I make about what I have learned?

Knowledge: How does this information inform my fundraising strategy?

Wisdom: How does this new outlook on my fundraising strategy drive organizational growth?

Sadly, most wealth screen services stop after the first stage and leave you on your own for the other three stages.

Interpreting this data and using it to inform your fundraising strategy is the key component here, and without it, you are left with lots of unwieldy data that is impossible for you to act upon efficiently.

We would like you to have a more wholistic view of the stages.

You can prevent “the data dump” problem by purchasing your data from fundraising counsel or fundraising firms that specialize in actually raising revenue. When you go through fundraising counsel or fundraising firms, you will receive implementation support on all four stages of the process and then have a far greater chance of turning that data into real donor giving.

Raising More Revenue?

Many nonprofits buy wealth screening services but when you investigate a year afterward, as we have with over 100 of our clients, very few have raised more revenue. In fact, most reported to us that the amount of data they received paralyzed them.

Why is that and how can you prevent this from happening to you?

The point of having the data is to turn it into revenue for your nonprofit. Knowing what to do with the data after it’s received is the real art of advanced fundraising. That is often outside the scope of service of the vendor who sold you the data but is of central concern to we fundraisers!

Most of all, the research is about connecting the insights of your data to deepen your fundraising strategy, and ultimately, connect that strategy to your organizational development. That’s where a skilled fundraising counsel is required, yet many of the nonprofits who have turned to us have skipped this step.

Fundraising Counsel/ Fundraising Firms

Just as an attorney advises his or her client, fundraising counsel is trained in the best practices of fundraising and helps you avoid common mistakes with the aim of raising the most revenue. Fundraising counsel is one who has gone through a rigorous process of study and experience concerning the best practices of fundraising. Involving someone so trained will help you use the data you’ve gathered in a strategic way. Their guidance helps you apply the data to your unique fundraising program and make it come to life. Imagine, if you will, a recipe without the chef. The chef makes the recipe come alive, just as fundraising counsel makes your data raise more revenue.

If you would like a free demonstration of LAPA’s wealth screen service and the guidance we give after the data is secured, please give Brian or Laurence a call at 212.932.9008 and we can set a time.

We welcome your comments about this post on the LAPA blog.